Monetary Policy Stance: Avoid those simplistic assessments

By R. Chand

I was surprised to note the facility with which one top economist, interviewed in this very paper, blamed the resurgence of inflation, coming back with a vengeance, to Budget 2011.

Moreover the same economist using the traditional cost push/demand pull theories, tried to convince us that “le comité de politique monétaire a voulu prendre le risque de baisser le taux d’intérêt de manière agressive par 100 points de base, rien que pour faire taire les exportateurs. A peine trois mois après, le Gouverneur de la Banque de Maurice, Rundheersing Bheenick, a dit que l’inflation remonterait plus vite que prévu, allant même jusqu’à anticiper une Year-on-Year Inflation supérieure à 7% en juin 2011”. As it is explained below this is a very simplistic way of assessing the monetary policy stance at a specific time under specific conditions.

How can one assess the stance of monetary

policy in a given period?

In general, assessing the stance of monetary policy is not straightforward. Effects of monetary policy on output and prices usually occur with a lag; many other factors besides monetary policy can be affecting the economy and disentangling the role of monetary policy in a given period can be quite challenging. Nonetheless, the behaviour of certain economic indicators can help if we examime some of these indicators.

For many countries, however, the proliferation of financial instruments, rapid innovations in the financial markets and the relatively instability of the velocity of money have made the behaviour of monetary aggregates fairly unstable and hence, an unreliable indicator. Thus, central bankers have tended to examine several monetary aggregates (M1, M2, M2+, etc.) simultaneously and mostly as a supplement to other indicators.

Interest rates provide an alternative means to assess the stance of monetary policy. Of course, there is a variety of interest rates but they typically move closely together. A rise in interest rates does not necessarily signal a contraction. Contrary to the assertion of our top economist, still locked up in cost and demand pull theories of inflation, that “the only way to control inflation is to jack up the interest rate”, a rise in interest rates does not necessarily signal a contractionary stance. Higher interest rates may be driven by higher (current or expected) inflation, and may actually be the result of a loose rather than a tight monetary policy.

In many countries we have seen (long run) interest rates decline significantly as a result of austere macroeconomic measures, including contractionary monetary policies intended to lower inflation. This is one instance where the short- and long-term interest rates may temporarily move in opposite directions: the short-term interest rates increasing as a direct consequence of the contractionary monetary policy, and the long-term interest rates decreasing in expectation of the future decline of the inflation rate. A rise in interest rates only indicates that monetary policy is tighter than it was but not necessarily that it is contractionary. In other words, the interest rate though rising may still be lower than the neutral rate.

Estimating the neutral interest rate presents some difficulties. But one has other choices like the changes in the yield spread, the overall structure of the interest rates, or the yield curve, as useful indicators. Thus we wish to caution our top economist that in a high inflation, high debt, and generally unstable environment, interest rates are likely to be volatile and must therefore be interpreted with caution. We have also the exchange rate, the Monetary Condition Index and the level of domestic credit and other assets that we should also take into consideration. To summarize it all, the monetary policy stance at a given period is assessed through various indicators namely monetary aggregates, interest rates and yield spreads, exchange rate, monetary conditions index and output gap.

We have to examine the different channels of transmission to understand the monetary policy transmission mechanism and to be able to gauge the final impact of monetary policy (interest rate, exchange rate. wealth, credit), the lags at different levels in the transmission mechanism, and the forward-looking behaviour and expectational channels of monetary policy. To disentangle the monetary policy impact requires a detailed knowledge of the state of the economy (financial sector, labour markets, debt structure, output gap position…) and the effect of a change in exchange rate pass-through on the transmission mechanism.

Equally important are the equilibrium concepts of neutral interest rate, equilibrium real exchange rate, potential output and the deviations in ‘gap’ variables versus the movements in equilibrium values. The types and nature of shocks also need to be correctly identified and interpreted before studying the monetary policy effects.

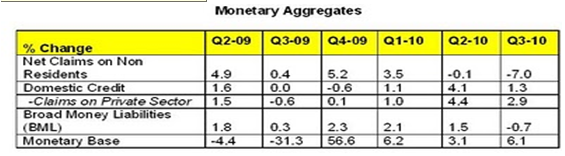

We had in a recent article analyzed the post-budget 2011 monetary policy stance along those lines examining the output gap, the level of liquidity in the banking system, the growth of credit, inflationary expectations and the external environment. Real output was still below potential and the negative output gap had contributed to keep inflationary pressures emanating from the supply side in check. There was still excess liquidity of nearly Rs 4.2 billion in the system despite efforts by the Central Bank to mop it up. The Bank of Mauritius had to “issue notes of longer-term maturities, ranging from two to four years, to pick up the slack created by net redemption of Treasury Bills. Surprisingly, the increasing liquidity in the system has not been accompanied by increasing demand for loanable funds. Credit to the private sector which picked up in the second quarter of 2010 dropped back to a 2.9% growth in the third quarter. The Governor was concerned that “our banks perhaps (are) becoming too risk averse. Is there an unmet demand for loans in parallel with excess liquidity in the system? If so, aren’t we failing to tap our full growth potential?”

As for inflationary expectations, there were upside risks for the short-to-medium term inflation outlook. The 7th Inflation Expectations Survey revealed that 84.5% of respondents expected prices to go up. The mean inflation rates of respondents worked out to be 3.1%, 3.6% and 4.3% respectively for the twelve months ending December 2010, June 2011 and December 2011.

As far as the external environment was concerned, recovery was stalling and was still in danger of petering out altogether; the advanced economies continue to expand at a lower pace. We were of the opinion that the lowering of the Repo Rate has provided only a temporary reprieve. It has not stimulated much borrowing either from households or cautious business. Banks held on to their excess reserves. If all the cheap money eventually had spurred much higher economic growth, these reserves would have turned into loans. There was thus very little reason for continuing with the lowering of the Repo Rate as the Central Bank would have only been “pushing on a string”.

As you see, every monetary policy stance is related to a number of fundamental economic indicators and these indicators are not easy to reconcile — domestic credit can be declining simultaneously with interest rates, and interest rates may be declining at the same time as the exchange rate is rising. We should thus avoid those simplistic assessment of the monetary policy stance at a given period with its specific parameters (indicators) in specific conditions (equilibrium concepts and nature of shocks) if we need to understand the state of the economy at that period.

* Published in print edition on 18 February 2011

An Appeal

Dear Reader

65 years ago Mauritius Times was founded with a resolve to fight for justice and fairness and the advancement of the public good. It has never deviated from this principle no matter how daunting the challenges and how costly the price it has had to pay at different times of our history.

With print journalism struggling to keep afloat due to falling advertising revenues and the wide availability of free sources of information, it is crucially important for the Mauritius Times to survive and prosper. We can only continue doing it with the support of our readers.

The best way you can support our efforts is to take a subscription or by making a recurring donation through a Standing Order to our non-profit Foundation.

Thank you.