A Potentially Disruptive Global Situation

Given the precarious global situation, the best we could do is to examine the options we have cool-headedly

There’s a lot of bad news, the world over, to begin with. An increasing number of “hot spots” has kept emerging in different parts of the world.

The Gulf crisis involving Saudi Arabia and Qatar in a face-off has barely abated. America has been pushing the Iranian nuclear deal to the edge without reckoning with the tension that will ensue, putting the Middle East at even greater risk. Yemen is in tatters, not only from continuing coalition bombing but also from disease and poverty affecting an impoverished and battered population.

Further east, the Myanmar crisis is seeing hundreds of thousands of people with barely anything to survive on, clinging to the last straw as they seek refuge in neighbouring Bangladesh. At the same time, while China has been pushing for securing control over the South China Sea, North Korea has been provocatively firing missiles over Japan. It has even tested a nuclear bomb last week, said to be 10 times as powerful as the one which devastated Hiroshima in the final days of World War II.

Venezuela in Latin America has the world’s largest proven oil reserves. In the heydays of a soaring oil market, its government used oil revenue to finance a massive miscalculated expansion of the public sector. As oil prices started plummeting in 2014, this model showed up its serious flaws: more than 80% of the population now lives in poverty; to avoid a coup, its present government gave the military a free hand to run the drug business, making generals and officials extremely rich but also tolerant to the excesses of a dictatorial government coming in place. There are currently no jobs on the market. Venezuela’s infant mortality rate has of late increased a hundred-fold. It is one of the two world major economies (the other being Saudi Arabia, -0.5%) The Economist forecasts will see its economic growth contract by 9% in 2017 – the fruit of misgovernment.

We may not have direct links with all these places of turmoil. However, we cannot overlook two facts – one, that through direct or indirect links with each other, a deteriorating global economic situation can filter down to us; two, that all these failings and the resulting global threats are the consequences of abuse of individual power-seeking and misrule.

There’s no guarantee that the currently ongoing UN General Assembly in New York will actually solve some of these crises. There are too many “hot heads” vindicating the righteousness of their thinking, unconcerned about how much the overall situation is getting imperilled by their misbehaviour and lack of reconciliation with ground reality.

The right signals

There’s not much a small economy such as that of Mauritius can do to improve this situation. But it can take serious note of the risk all this entails for our well-being. As if that were not enough, there’s a big risk also coming now from misgovernance of financial markets in different parts of the world.

As it is well known, central banks of the world’s richest countries have kept pumping a lot of liquidity into their economies, to ward off their collapse in the wake of the international economic crisis of 2007-08. This has temporarily shelved away the risk posed by government and private over-indebtedness. The Bank of England alone has bought up government bonds and private investment grade securities of some £465 billion to date; central banks in the US, Europe and Japan have done the same on a huge scale. All this liquidity has swollen up stock and property prices the world over.

Mauritius’ stock exchange would not have escaped the fallout of resulting artificial swelling up of certain stock and real estate prices accompanying this global influx of liquidity. Whoever speaks of inflated stock or property prices is also concerned about their eventual collapse when the liquid funds flow out.

Consider one of the mainstays of our economy in the face of a fundamentally weak balance of payments condition – inflows of Foreign Direct Investment (FDI). Data show that our FDI inflows were: Rs 18.5 billion in 2014, Rs 9.7 billion in 2015 and Rs 13.6 billion in 2016 – volatile. Of the total inflows during the three years, 55% came from Europe and 35% from South and East Asia, induced partly by the injections of liquidity by big central banks in their countries.

Any policy change can reverse the tide. Also, it is not difficult to realize the significant impact of FDI inflows on inflating domestic property prices once it is understood that not less than 58% of all FDI received by the country has gone into real estate during the three years to 2016. This concentration of inflows shows besides that there is insufficient diversification into other profitable activities productively receiving such foreign investments.

Two essential economic assets

Given the precarious global situation, the best we could do is to examine the options we have cool-headedly. In this context, one can think of two essential economic assets we have that we cannot afford to lose at all costs.

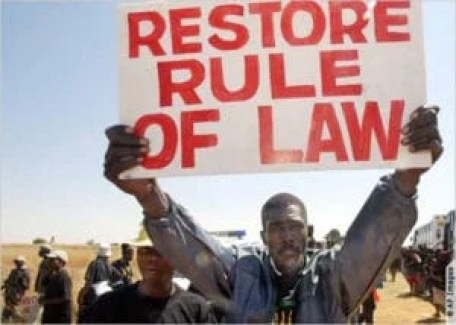

They are: the rule of law and strong independent public institutions.

The rule of law is important inasmuch as it guarantees that the framework cannot be changed at the whims and caprices of decision-makers. Despite the criticality of this factor, some of the most rash, incompetent and inconsistent decisions were taken in 2015 and 2016 to display, as it were, that the framework was flexible and not cast in iron. The opposite signal now needs be given to confirm our abidance with the rule of law.

Successive governments have made weak our public institutions, possibly to manipulate them for political conveniences of all sorts. The consequence has been a weakening of the inherent trust that they will take the decisions that ought to be taken “without ill will, fear or favour” towards anyone. Yet, not being resource-rich as some of the countries indulging in outrageous behaviour at the global level, this factor could have proved to be a key resource in our quest for more and better external markets. Our public institutions would have worked as they should have.

If we do the necessary repairs with respect to these two factors, we can move things more enduringly in our favour.

- Published in print edition on 22 September 2017

An Appeal

Dear Reader

65 years ago Mauritius Times was founded with a resolve to fight for justice and fairness and the advancement of the public good. It has never deviated from this principle no matter how daunting the challenges and how costly the price it has had to pay at different times of our history.

With print journalism struggling to keep afloat due to falling advertising revenues and the wide availability of free sources of information, it is crucially important for the Mauritius Times to survive and prosper. We can only continue doing it with the support of our readers.

The best way you can support our efforts is to take a subscription or by making a recurring donation through a Standing Order to our non-profit Foundation.

Thank you.